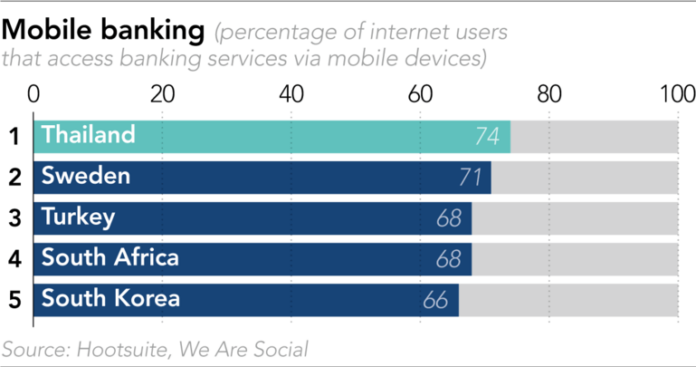

In Thailand, 74% of internet users access banking via mobile, surpassing the global average. Southeast Asia leads in mobile economy growth, with investments driving increased mobile internet usage and digital payments.

Mobile Banking Dominance in Thailand

In Thailand, 74% of internet users access banking services through mobile devices, significantly surpassing the global average of 41% and even China’s 61%. This trend highlights the region’s growing reliance on mobile technologies, underscored by the Thai government’s push toward a cashless economy.

Southeast Asia’s Digital Revolution

Southeast Asia is experiencing a robust digital transformation, fueled by startup investments and higher mobile e-commerce penetration. With daily mobile internet usage peaking at 5 hours and 13 minutes for Thais, the expectation is that the region’s internet economy will triple by 2025, creating substantial opportunities for global investors.

Thailand has emerged as a leader in mobile banking penetration in Southeast Asia, driven by the rapid adoption of smartphones and the increasing demand for digital financial services. A combination of favorable demographics, high internet connectivity, and supportive government initiatives has propelled the growth of mobile banking platforms across the country. With a significant percentage of the population accessing banking services through their mobile devices, traditional financial institutions are evolving to meet consumer expectations for convenience and flexibility.

Key players in the Thai banking sector are investing heavily in technology to enhance user experience and security features. This has resulted in a surge of innovations, such as digital wallets and contactless payment solutions, which cater to the growing preference for cashless transactions. Additionally, regulatory frameworks established by the Bank of Thailand promote competition and encourage fintech startups, further fueling the mobile banking ecosystem. As a result, Thailand is set to maintain its position at the forefront of mobile banking services in the region.