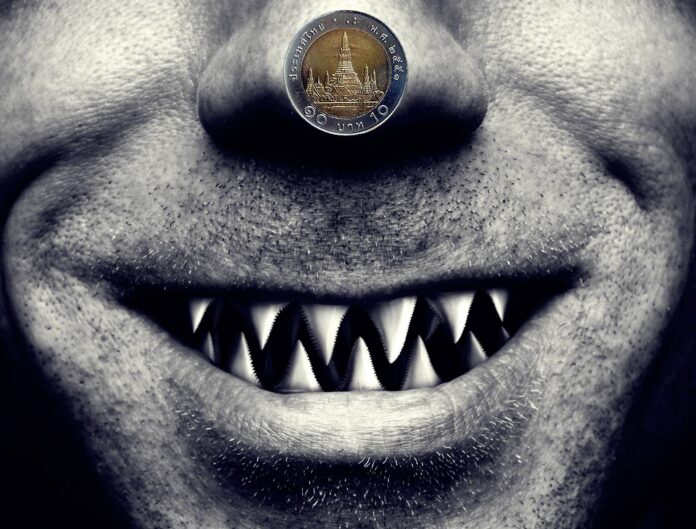

The Bank of Thailand is focused on addressing household debt problems by implementing debt assistance programs, regulating interest rates and fees, and fostering financial discipline.

Addressing Household Debt Problems

The Bank of Thailand (BOT) has set out to address household debt problems through various measures. It has implemented debt assistance programs and issued guidelines on Responsible Lending for creditors, with the goal of ensuring fairer debtor protection. The BOT’s efforts include continuing debt restructuring for retail and SME debtors facing repayment difficulties, resolving persistent debt among vulnerable groups with higher interest payments, and regulating interest rates, fees, and providing accurate financial information.

Resolving Persistent Debt

Beginning in April 2024, measures will be put in place to resolve persistent debt among vulnerable groups with higher interest payments. This will offer assistance to speed up debt repayment and reduce the burden of interest. Individuals with revolving personal loans that have had a higher proportion of interest payments than principal payments over the past 3-5 years will receive assistance from creditors.

Importance of Responsible Borrowing

Additionally, the BOT emphasizes the importance of debtors’ responsible borrowing and financial discipline. It will closely supervise creditors to ensure compliance with regulations and offer appropriate assistance to debtors, utilizing new tools and data for effective monitoring and proactive supervision. The BOT’s goal is to foster financial discipline through responsible borrowing.

Source : Addressing Thailand’s household debt problems (BoT)