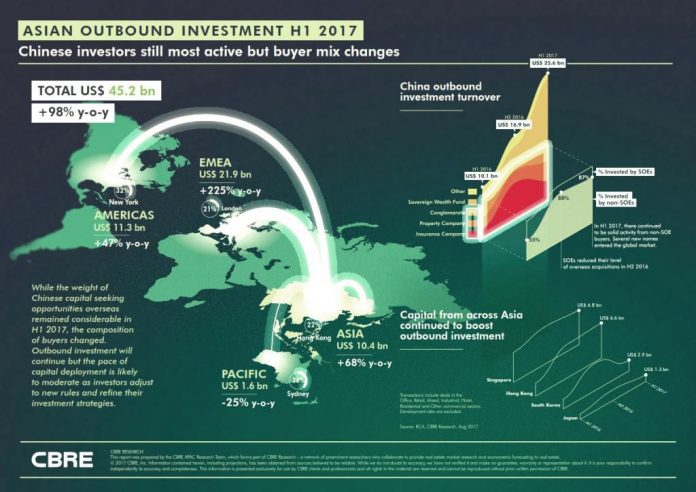

Asian cross-border investment surged by 98% y-o-y to US$ 45.2 bn in H1 2017. The increase was partly due to a one-off US$ 13.2bn purchase of a logistics portfolio in EMEA.

Chinese investors remained most active but the composition of buyers changed amid increased scrutiny of cross-border capital flows.

Other major sources of capital including Singapore, Hong Kong, Korea and Japan all saw higher levels of outbound investment. One continuing trend is that of fewer but larger deals.

The Americas and EMEA remained the preferred regions for Asian cross-border investment but turnover within Asia also increased. London, New York and Hong Kong are still the top three destinations.

Chinese outbound investment is still at a nascent stage and is set to continue as a long term trend.

In the short term, the buyer mix is likely to change and the pace of investment may moderate as investors refine their investment strategies and adjust to new rules.