Further enhancing Thailand’s reputation as a popular shopping destination for travellers from around the world, is the VAT Refund for Tourists scheme which offers holidaymakers a refund on goods they purchase during their trip.

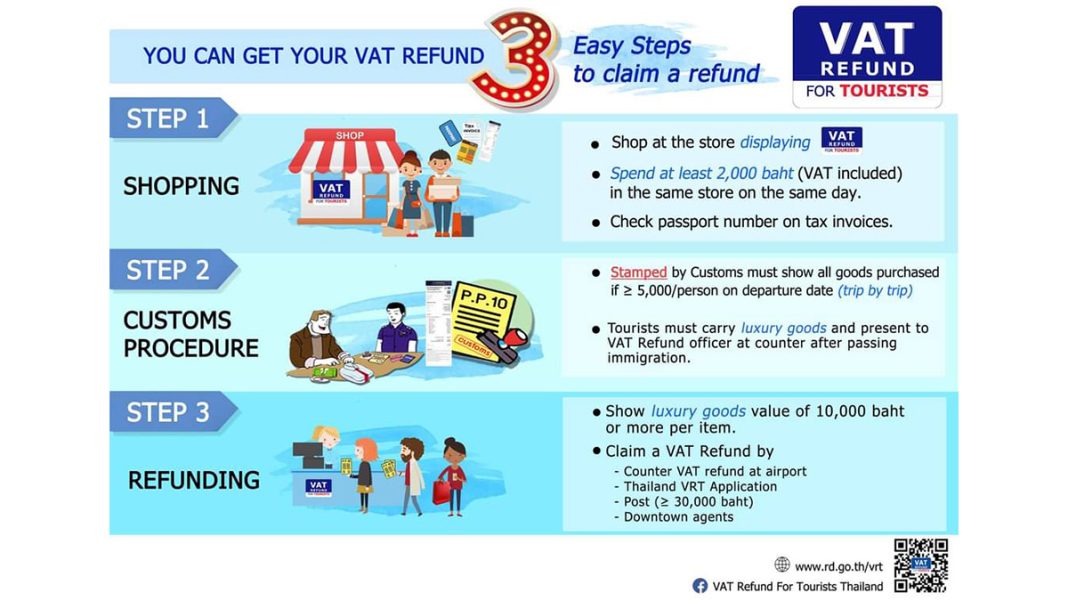

To qualify for the refund, goods must be purchased from stores displaying the ‘VAT Refund for Tourists’ sign, and be to the value of at least 2,000 Baht (VAT included) per day per store. The total value of all goods purchased must be at least 5,000 Baht per person per trip.

The goods must be taken out of Thailand by the tourist within 60 days of the date of purchase through any of the international airports in Bangkok (Suvarnabhumi or Don Mueang), Chiang Mai, Chiang Rai, Phuket, Hat Yai, U-Tapao, Krabi, and Samui.

In the case the VAT refund is made at a refund location in the city, departure from Thailand must be within 14 days of this date.

Here are some important points to remember:

At the time of purchase

When purchasing the goods, the tourist must present his/her passport and ask the store to issue a VAT Refund Application for Tourists form (P.P.10) along with the original tax invoice/s for the purchase. The passport number must be correct on the form.

*In the case of consumable goods, these must be sealed along with the message ‘No Consumption Made While in Thailand’.

At the airport when departing Thailand

The purchased goods, of which the total value must be 5,000 Baht or more, must be presented along with the VAT Refund Application for Tourists form and original tax invoice/s to a customs officer for inspection before check-in.

In the case of luxury goods (jewellery, gold, ornaments, watch, eyeglasses, pen, mobile or smart phone, laptop or tablet, handbag, and/or belt) of which the value is 10,000 Baht or more per item, and carry-on goods of which the value is 50,000 Baht or more per item, these must be hand carried and showed again at the VAT Refund for Tourists Office after passing through immigration.

At the VAT Refund for Tourists Office, if the refund amount is not over 30,000 Baht with insurance for the tax refund amount, the payment will be made in cash (Thai Baht).

The refund can also be claimed by post to the Revenue Department of Thailand, or by drop-box in front of the VAT Refund for Tourists Office at the airport, and at the downtown refund office locations.